Growing Pay-TV, CASBAA Connections Q1

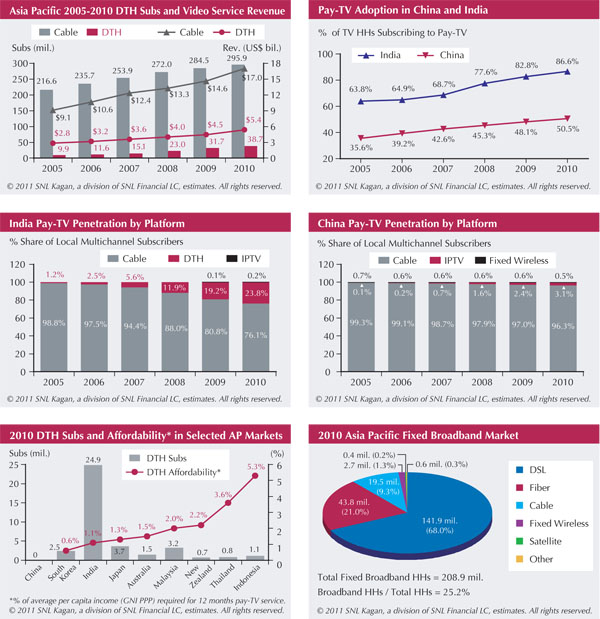

Asia Pacific’s pay-TV market has evolved significantly in the past five years due to the proliferation of DTH and IPTV services alongside cable’s steady digitization. SNL Kagan analysis indicates Asia Pacific’s cable video service economy grew from $9.1 billion in 2005 to $17.0 billion in 2010 while DTH nearly doubled revenues to $5.4 billion as subscribers quadrupled to 38.7 million.

The top story in Asia Pacific’s pay-TV business is the rise of DTH in India, where new market entrants have increased subscriber share from 1.2% in 2005 to 23.8% in 2010. Leading players Dish TV, Sun Direct, Tata Sky, Bharti Airtel and Reliance have grown to rank among the world’s largest operators having added a combined 8.2 million subscribers in 2009. Growth continues with the group adding a further 4.2 million subscribers in H1 2010.

In China, cable continues to dominate with 96.3 % subscriber share in 2010, though IPTV is gaining traction with a 3.1% share. Cable system consolidation is underway in China following a government-mandated “One Province, One Network” directive, which will produce multiple operators serving more than 10 million subscribers.

Asia Pacific hosts the world's largest fixed broadband subscriber population, with 208.8 million subscribers at end-2010. DSL dominates the landscape accounting for 68% of the region’s fixed broadband households, followed by fiber-to-the-premises with 21 % share and cable broadband with 9.3% share. With just 25.2% of Asia Pacific’s households subscribing to broadband in 2010, the region is poised to see continued strong growth for the foreseeable future.